The Most Professional Report of Global Strategic Business for B2B Connected Living Room Growth to 2030 & The Best Amazing Forecast

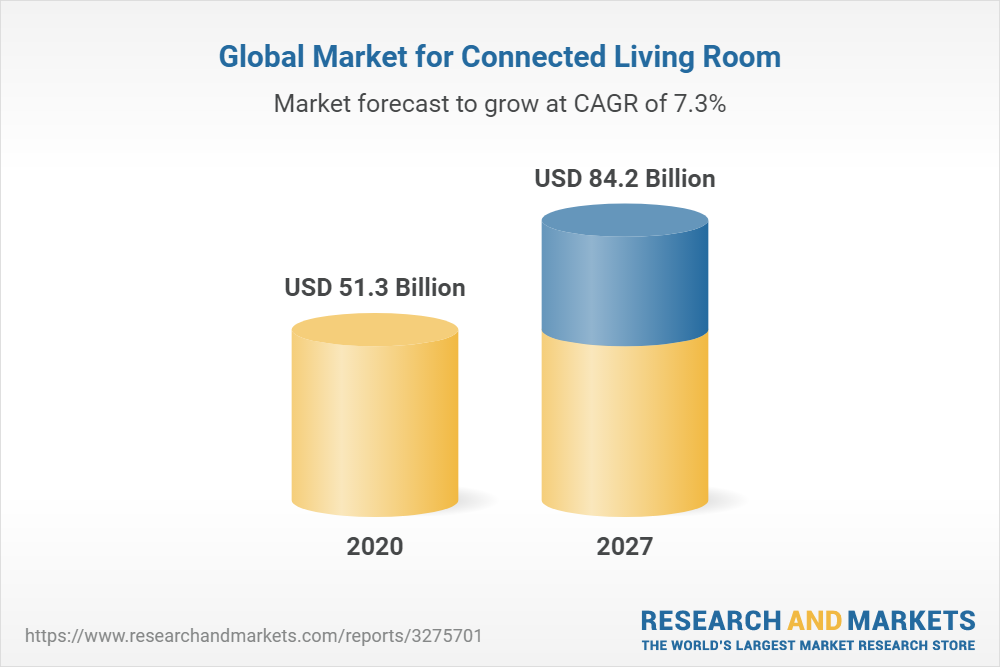

In the changed post COVID-19 business landscape, the global market for Connected Living Room estimated at US$60.6 Billion in the year 2022, project to reach a revised size of US$107.2 Billion by 2030, growing at a CAGR of 7.4% over the analysis period 2022-2030.

Resource:research and markets

https://www.researchandmarkets.com/reports/3275701/connected-living-room-global-strategic-business

Moreover. NEWS LINK. http://decobase.com.tw/news/

Global Connected Living Room Market to Reach $107.2 Billion by 2030

In the changed post COVID-19 business landscape, the global market for Connected Living Room estimated at US$60.6 Billion in the year 2022, project to reach a revised size of US$107.2 Billion by 2030, growing at a CAGR of 7.4% over the analysis period 2022-2030. Smart TVs, one of the segments analyzed in the report, project to record 7.3% CAGR and reach US$45.3 Billion by the end of the analysis period. Moreover, taking into account the ongoing post pandemic recovery, growth in the Smartphones segment readjust to a revised 8.6% CAGR for the next 8-year period.

The U.S. Market is Estimated at $16.4 Billion, While China is Forecast to Grow at 12% CAGR

The Connected Living Room market in the U.S. estimate at US$16.4 Billion in the year 2022. China, the world’s second largest economy, forecast to reach a projected market size of US$26.1 Billion by the year 2030 trailing a CAGR of 12% over the analysis period 2022 to 2030. Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at 3.2% and 6.3% respectively over the 2022-2030 period. Within Europe, Germany forecast to grow at approximately 4% CAGR.

Looking Ahead to 2023

The global economy is at a critical crossroads with a number of interlocking challenges and crises running in parallel. The uncertainty around how Russia`s war on Ukraine will play out this year and the war`s role in creating global instability means that the trouble on the inflation front is not over yet. Additionally, food and fuel inflation will remain a persistent economic problem. Higher retail inflation will impact consumer confidence and spending.

In addition, as governments combat inflation by raising interest rates, new job creation will slowdown and impact economic activity and growth. Furthermore, lower capital expenditure is in the offing as companies go slow on investments, held back by inflation worries and weaker demand. With slower growth and high inflation, developed markets seem primed to enter into a recession.

Fears of new COVID outbreaks and China’s already uncertain post-pandemic path poses a real risk of the world experiencing more acute supply chain pain and manufacturing disruptions this year. Moreover, volatile financial markets, growing trade tensions, stricter regulatory environment and pressure to mainstream climate change into economic decisions will compound the complexity of challenges faced.

In conclusion, year 2023 expect to be tough year for most markets, investors and consumers. Nevertheless, there is always opportunity for businesses and their leaders who can chart a path forward with resilience and adaptability.